Business Insurance in and around Kent

Calling all small business owners of Kent!

Insure your business, intentionally

Help Protect Your Business With State Farm.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, trades and more!

Calling all small business owners of Kent!

Insure your business, intentionally

Protect Your Business With State Farm

Your business thrives off your commitment determination, and having outstanding coverage with State Farm. While you do what you love and lead your employees, let State Farm do their part in supporting you with commercial liability umbrella policies, artisan and service contractors policies and business owners policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Cesar Ramos is here to help you explore your options. Call or email today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

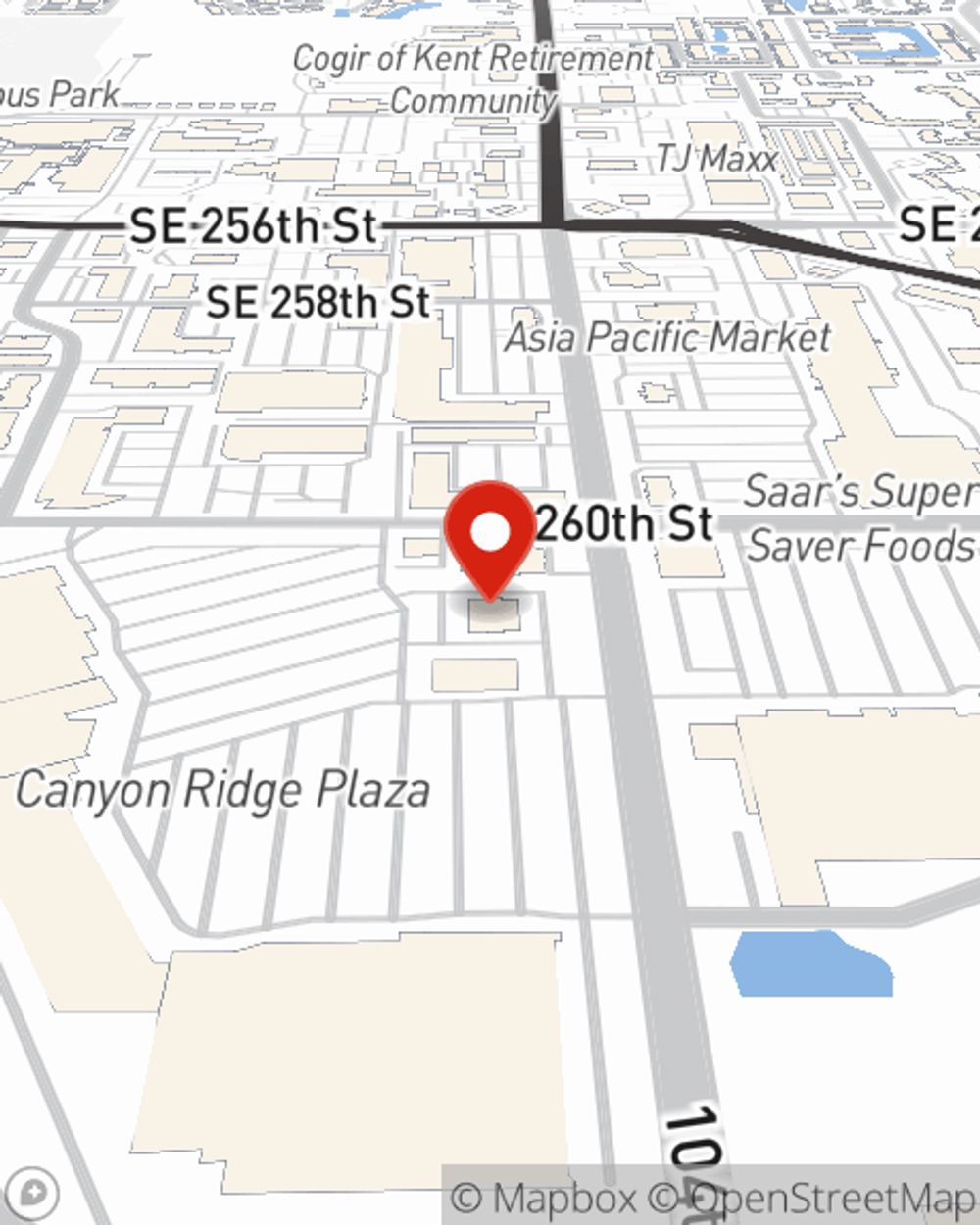

Cesar Ramos

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.